But is everything okay? Why do we see a worrying decline in the health of Cybersecurity Enterprise IronNet?

The cybersecurity company IronNet (NYSE: IRNT) began trading on the NYSE on August 27, 2021. August 27, 2021. Thanks to IronNet’s founder and co-CEO, Gen. Keith Alexander, a retired four-star general who previously led the National Security Agency (NSA), the Central Security Service (CSS), and the U.S. Cyber Command; the company grabbed a lot of attention, leading to a SPAC (special purpose acquisition company) merge.

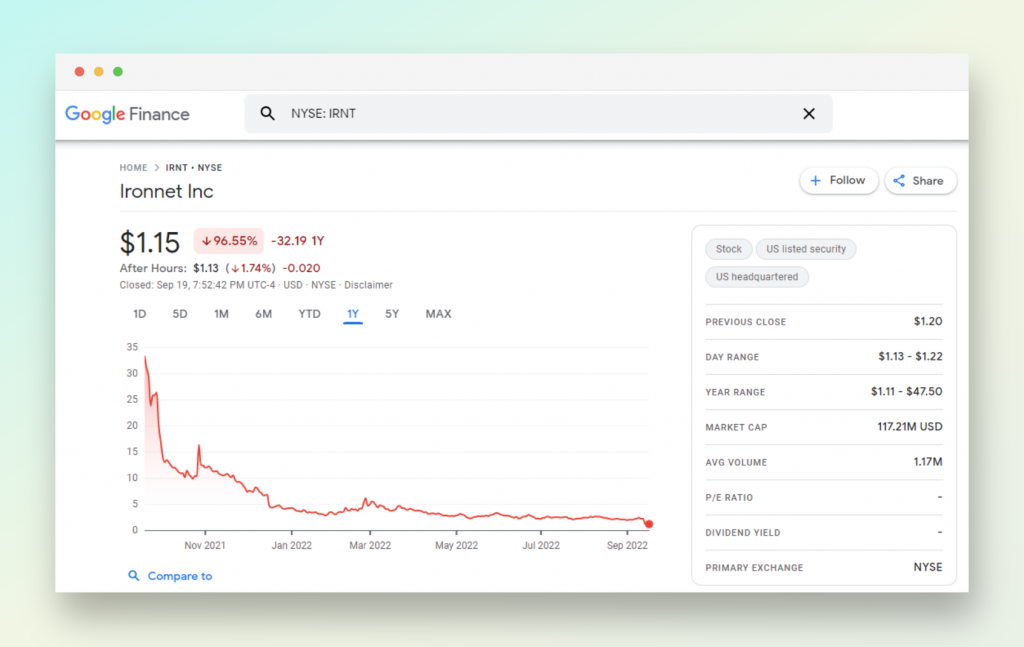

IronNet’s shares debuted at $13.44 after the merger, soared to a record high of $41.40 in September of last year, and currently trade for just above $1. Let’s examine five blatant red signs to comprehend why IronNet’s stock plummeted.

Misrepresentation of Capabilities

IronNet’s platform protects corporations against cyberattacks using AI-driven behavioral analytics and collective defense capabilities (which collect and share data across different industries and companies). IronNet claimed in its pre-merger presentation that its technology provided a “fundamentally new layer of defense” in the cybersecurity business.

IronNet acknowledged in recent SEC filings that it confronts direct competition from similar network detection and response (NDR) service providers, such as DarkTrace and Vectra Networks, and diversified network security providers, such as Cisco and Palo Alto Networks. This rivalry appears to have hindered IronNet from meeting its lofty pre-merger growth objectives.

IronNet predicted in its investor presentation that its revenue would increase by 25% to $28.9M in fiscal 2021 (which ended in January), 87% to $54.2M in fiscal 2022, and 105% to $110.8M in fiscal 2023.

IronNet’s sales increased 26% to $29.2M in the fiscal year 2021 but fell 6% to $27.5M in the fiscal year 2022. In the first half of fiscal 2023, the company’s revenue increased by only 7% year-over-year to $13.3 million, and it retracted its former projection of 25% revenue growth for the full year.

This year, Palo Alto Networks anticipates a 25% increase in revenue to approximately $6.9B. It is typically a warning sign when an underdog grows more slowly than a larger rival.

A Steep Decline in ARR

IronNet finished the fiscal year 2022 with 88 clients. This figure increased to 91 during the first quarter of 2023 but decreased to 78 during the second quarter. As a result, its annual recurring revenue (ARR) decreased from $31.8M at the end of the fiscal year 2022 to $26.5M at the end of the first half of the fiscal year 2023.

Dwindling Margins & Widening Losses

IronNet predicted in its SPAC presentation that its gross margins would increase from 71.2% in fiscal 2020 to 74.2% in fiscal 2023. The company’s gross margin increased to 76% in fiscal 2021 before falling to 65.9% in fiscal 2022 and 62.2% in the first half of fiscal 2023. Palo Alto concluded their most recent fiscal year with a gross margin of 68.8%.

These diminishing margins are cause for concern because IronNet is still profoundly unprofitable. Its operating loss increased to $55.3M in fiscal 2021, then more than quadrupled to $228.8 million in fiscal 2022 (relative to its investor presentation projection of a $49.1M operating loss). In the first half of fiscal 2023, the company’s net loss increased from $32.3M to $60.6M.

IronNet wants to lay off 110 employees, or 35 percent of its total employment, to reduce expenses. However, the company may become even less competitive if it shrunk in size.

Depleting Cash Reserve

Cybersecurity enterprise IronNet concluded the second quarter with a cash and equivalents balance of $9.7M. After the quarter’s conclusion, it borrowed an additional $10M, but these new notes mature in only 18 months and carry a hefty interest rate of 5%. This is a grave situation for a business that would likely lose tens of millions in the year’s second half.

Co-CEO and CFO Resign

Two of IronNet’s highest-ranking officials, co-CEO William Welch and CFO James Gerber, abruptly quit amid this existential crisis. Alexander will become the only CEO, while Cameron Pforr, the president of Fidelis Cybersecurity, will replace Gerber. The enterprise announced that Gerber is leaving IronNet to join a private cybersecurity firm, while Welch is resigning “in light of the business restructure.” These startling leadership changes may make it more difficult for IronNet to adopt a clear turnaround strategy while maintaining its financial stability. ♦

Dear Reader,

First, thank you for your precious time reading the stories (without paywalls) I publish on Startups to Enterprises covering the EU, China, the US, and India. Second, I request you to contribute financially (any amount) to help me sustain this as an independent digital business news media.

If I receive a request for a sponsored post, I ensure I see merit that is meaningful for erudite and informed readers like you. In the bargain, I lose out on sponsorships wherein I need funds to sustain this effort. Your contribution helps me stay afloat.

Please note that your contribution is treated as revenue generated and not a donation; hence, there are no 80G or other donation certificates. In fact, as I am eligible to pay for the revenue generated, I will pay taxes on the same.

You deserve to know that I abide by journalistic ethics and practices to ensure I tell the stories as is, unbiased. You can follow us on Facebook, Linkedin, and Twitter, bookmark us on Google News, and finally, PayPal us here.

Founding Editor

Linda Ashok